How to Find a Bankruptcy Lawyer: Tips for Choosing the Right Attorney

If you’re overwhelmed with debt and considering bankruptcy, you’re not alone. Millions of Americans face financial hardships due to job loss, medical expenses, or unexpected life changes. Filing for bankruptcy can be a way to get a fresh financial start, but it’s crucial to have the right legal guidance.

In this article, we’ll discuss how to find a bankruptcy lawyer, how much they cost, whether you need one, and what exactly they do to help you. By the end, you’ll have all the information needed to make an informed decision about hiring a bankruptcy attorney.

Do You Need a Lawyer to File Bankruptcy?

One of the most common questions people ask is whether they need a lawyer to file for bankruptcy. The simple answer is: No, you are not legally required to hire a lawyer, but it’s highly recommended.

Can You File for Bankruptcy Without a Lawyer?

Yes, you can file for bankruptcy without a lawyer, which is known as filing pro se. However, this approach is extremely risky. Bankruptcy laws are complex, and the paperwork involved can be overwhelming. Making a small mistake could lead to your case being dismissed or even put you at risk of losing valuable assets.

Why Hiring a Lawyer to File Bankruptcy Is a Smart Choice

A lawyer to file bankruptcy can guide you through the legal system and ensure that you avoid costly errors. Here’s why hiring a bankruptcy attorney is beneficial:

- They help you choose the right bankruptcy type – There are two main types of personal bankruptcy:

- Chapter 7: This is a liquidation bankruptcy, meaning some of your assets may be sold to pay creditors. It’s the fastest and most common type.

- Chapter 13: This involves creating a repayment plan to pay off debts over three to five years. It’s ideal if you have a steady income but need help managing debt.

- They handle all paperwork and deadlines – Bankruptcy filings require extensive forms, financial records, and strict deadlines.

- They protect your assets – A lawyer will help you claim exemptions that allow you to keep necessary possessions, such as your home or car.

- They deal with creditors – Once you file, creditors are required to stop collection efforts. Your lawyer will handle communication to prevent harassment.

- They represent you in court – If hearings or meetings with creditors are required, your attorney will be by your side.

When You Might Not Need a Bankruptcy Lawyer

If you have little to no assets, a very simple financial situation, and a solid understanding of bankruptcy law, you might be able to file without an attorney. However, even in simple cases, a lawyer can save you time and stress.

How Much Is a Bankruptcy Lawyer?

How much is a bankruptcy lawyer varies depending on factors such as:

- Your location – Legal fees are generally higher in big cities than in smaller towns.

- The complexity of your case – If you own multiple properties, have significant assets, or face lawsuits, your case will be more complex and expensive.

- The chapter of bankruptcy you file – Chapter 13 cases usually cost more than Chapter 7 due to their complexity.

Most bankruptcy lawyers offer payment plans, meaning you don’t have to pay the full amount upfront. Some attorneys also provide free initial consultations to discuss your case before committing.

How to Find a Bankruptcy Lawyer

Now that you understand the importance of hiring a lawyer, let’s discuss how to find a bankruptcy lawyer that fits your needs.

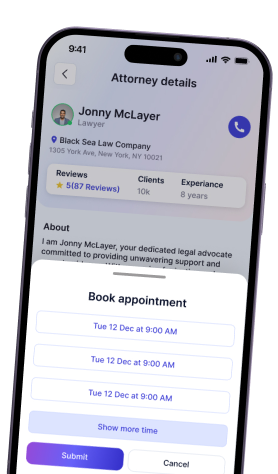

1. Use Online Directories

Many websites specialize in helping people find a bankruptcy lawyer. Some of the best platforms include:

- National Association of Consumer Bankruptcy Attorneys (NACBA) – A trusted resource for experienced bankruptcy lawyers.

- American Bar Association (ABA) – Provides listings of accredited attorneys.

- Avvo, Justia, and FindLaw – Offer lawyer reviews, ratings, and contact information.

2. Read Online Reviews and Testimonials

Before hiring a lawyer, check reviews on Google, Yelp, Avvo, and other platforms. Look for attorneys with:

- High ratings (4 stars and above)

- Positive client feedback about communication and success rates

- Experience handling bankruptcy cases similar to yours

3. Ask for Personal Referrals

If you know someone who has filed for bankruptcy, ask about their lawyer’s experience. Personal recommendations can be one of the best ways to find a reliable attorney.

4. Schedule Free Consultations

Many lawyers offer free consultations. Use this opportunity to ask:

- How much experience they have with bankruptcy cases

- What their fees include

- How they communicate with clients

- What their strategy would be for your case

5. Verify Credentials and Specialization

Make sure your lawyer:

- Is licensed in your state

- Specializes in bankruptcy law

- Has a good reputation with the state bar association

What Does a Bankruptcy Lawyer Do?

Many people wonder, what does a bankruptcy lawyer do? Here’s a detailed breakdown of their responsibilities:

1. Evaluating Your Financial Situation

A bankruptcy lawyer will assess your income, debts, and assets to determine whether bankruptcy is the best option. If another debt relief strategy is better, they’ll let you know.

2. Preparing and Filing Legal Documents

Filing for bankruptcy involves complicated paperwork. Your attorney will:

- Gather financial documents

- Fill out bankruptcy forms

- File paperwork with the court

Mistakes in paperwork can lead to case dismissal or denial of debt discharge, so professional help is crucial.

3. Representing You in Court and Meetings

Depending on your case, you may need to attend:

- A meeting with creditors (341 hearing) – Your lawyer will help prepare you and respond to creditor questions.

- Court hearings – If needed, your attorney will present your case in front of a judge.

4. Stopping Creditor Harassment and Lawsuits

Once you file for bankruptcy, an automatic stay goes into effect. This means:

- Creditors must stop collection calls and letters.

- Foreclosures, wage garnishments, and lawsuits are paused.

Your lawyer ensures creditors follow the law and protects your rights.

5. Helping You Rebuild Credit After Bankruptcy

A great bankruptcy lawyer doesn’t just help you through the legal process—they also offer guidance on how to recover financially. Many attorneys provide advice on:

- Creating a budget to avoid future debt problems

- Rebuilding your credit score through secured credit cards and responsible spending

- Avoiding common financial mistakes after bankruptcy

Finding the right bankruptcy lawyer can make all the difference in achieving a fresh financial start. Whether you’re struggling with overwhelming debt or facing foreclosure, an experienced attorney can guide you through the legal process.

Need expert help? Download OwchBuddy today to connect with legal professionals and access valuable financial resources!

Thank you for your comment

It will be published after moderation

OwchBuddy

OwchBuddy

Comments 0