How Much Does a Probate Lawyer Cost?

Losing someone you love is hard enough. But when you’re suddenly faced with legal forms, court deadlines, and confusing financial documents, it can feel overwhelming fast. If you’ve heard the word “probate” and wondered what it all means and how much a probate lawyer might cost, you’re not alone.

Many families reach out to OwchBuddy with the same question: “Do I really need a probate lawyer — and if so, how much is it going to cost me?” Let’s walk through it all, clearly and calmly. No legal jargon, no pressure – just the facts.

First Things First: What Is Probate?

Probate is the legal process of settling someone’s estate after they pass away. That usually includes:

- Proving the will is valid (if there is one);

- Identifying and gathering assets;

- Paying debts, taxes, and final expenses;

- Distributing what’s left to the rightful heirs.

Sometimes it’s quick and simple. Other times it can take months or even longer, depending on the estate size, whether there’s a will, and whether anyone contests it. A probate lawyer is there to guide you through it, make sure the paperwork is done right, and help avoid costly mistakes or delays.

So How Much Does a Probate Lawyer Cost?

Like most legal services, the cost depends on a few factors. But here’s a general breakdown:

1. Hourly Rate

Most probate lawyers charge by the hour, especially for cases with unknown variables.

- Typical hourly rate: $200-$500/hour;

- Average total cost: $3,000-$7,000 for a standard case;

- Complex cases: $10,000+ if litigation or multiple properties are involved.

2. Flat Fee

Some attorneys offer a flat fee for simpler estates. That means one set price for handling the entire probate process from start to finish.

- Typical flat fees: $2,500-$6,000;

- Good for uncontested wills and smaller estates;

Always ask what the flat fee covers and what it doesn’t.

3. Percentage of the Estate

In a few states (like California and Florida), lawyers are allowed to charge a percentage of the estate’s value — often around 2% to 4%. That means if the estate is worth $500,000, legal fees could range from $10,000 to $20,000.

It sounds high — and it is. That’s why many families prefer hourly or flat-fee arrangements when available.

What Affects the Final Price?

No two estates cost the same to settle because the workload can vary from a few forms to a year of court hearings. Here are the five biggest price drivers.

| Cost Driver | Why It Matters | Typical Impact on Fees |

| Estate Size & Asset Mix | More bank accounts, brokerage portfolios, and personal property mean extra inventories, appraisals, and accountings. | A small estate (≤ $100k) may close for $2–4k in legal fees; multimillion-dollar estates often exceed $10k. |

| Presence—and clarity—of a Will | No will (intestacy) or an ambiguous will forces the lawyer to follow strict statutory heir rules and seek additional court approvals. | Adds petitions and delays; expect 25–40% higher fees if the will is missing or contested. |

| Debts & Tax Obligations | Negotiating with credit-card companies, medical providers, or the IRS means more correspondence, filings, and possible audits. | Complex tax or creditor work can add $1–3k in attorney hours plus accountant costs. |

| Family Conflict | Sibling rivalries, second-marriage disputes, or challenges by excluded heirs trigger motions, mediation, or court hearings. | Legal fees can double (or worse) when litigation erupts; some lawyers switch to hourly billing. |

| Real-Estate Complications | Selling a house, transferring out-of-state property, or clearing title issues requires extra deeds, filings, and sometimes ancillary probate. | Each property sale commonly adds $500–$1k in legal work, plus recording and transfer fees. |

The cleaner the paperwork and the calmer the family, the lower your probate bill. When any of these factors appear, expect costs and the timeline to rise accordingly.

What Are You Paying For?

Hiring a probate attorney isn’t just buying a signature. It’s paying for a professional project-manager who keeps the estate on track from first filing to final distribution. Here’s what their work really includes.

| Key Task | Why It Matters |

| Prepare & file court petitions | Opens the estate, secures your legal authority as executor, and satisfies every procedural rule, so the judge issues orders without delay. |

| Notify heirs, beneficiaries & creditors | Legally required notices start the claims clock ticking and protect the estate from surprise lawsuits later on. |

| Inventory, appraise, and safeguard assets | Ensures nothing “goes missing,” assigns accurate values for taxes, and provides a clean accounting to the court and beneficiaries. |

| Track all statutory deadlines | Miss a notice or accounting date and the judge can fine or replace the executor. Your lawyer’s docket system prevents costly slip-ups. |

| Settle debts & taxes | Negotiates with credit-card companies, hospitals, or the IRS, files final income and estate-tax returns, and wards off personal liability for unpaid bills. |

| Resolve disputes | Mediates sibling squabbles or challenges from disinherited heirs, often saving thousands in litigation fees. |

| Distribute assets & close the estate | Drafts receipts and releases, so heirs can’t later claim you handled property incorrectly, then secures the court order that officially ends your responsibility. |

In short: they keep the process from going off the rails. And if something does go wrong – they’re there to fix it before it becomes a legal disaster.

Can You Do Probate Without a Lawyer?

Yes, in some cases. If:

- The estate is very small (under your state’s small estate limit);

- There’s a valid will;

- All heirs get along;

- No real estate or large debts are involved.

You might be able to handle probate yourself. But even then, it’s easy to miss deadlines or file forms incorrectly — which can delay the process or even trigger court hearings.

For peace of mind (and faster resolution), many families still choose to hire a lawyer — especially if they’re grieving or handling things from out of state.

What If You’re Worried About Affording It?

You’re not alone. Probate comes at a time when many families are already financially and emotionally stretched. The good news?

- Legal fees are paid from the estate, not your pocket (in most cases);

- Many lawyers offer payment plans or deferred billing;

- You can shop around — consultations are often free;

- Some cases qualify for limited-scope representation, meaning the lawyer handles just the tricky parts.

OwchBuddy connects you with attorneys who understand that this is a sensitive time — and who treat you like a person, not just a case file. You’ll get all the legal help needed at a reasonable cost.

Questions to Ask a Probate Lawyer Before You Hire Them

Before hiring a lawyer, ask them the following:

- Do you charge hourly, flat rate, or a percentage of the estate?

- What’s your estimate based on the details I’ve shared?

- What services are included in your fee?

- Have you handled cases like mine before?

- Will you communicate with family members or just me?

- Can you help with real estate, taxes, or out-of-state property?

The right lawyer won’t rush you. They’ll walk you through everything and give you real answers, not legalese.

How OwchBuddy Can Help

We know probate isn’t something most people are prepared for. And we also know it’s not something you want to face alone.

At OwchBuddy, we:

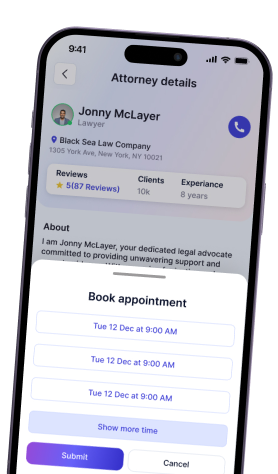

- Connect you with compassionate, experienced probate lawyers;

- Help you understand pricing, timelines, and expectations;

- Walk you through the process — step by step;

- Offer support even if the case gets complicated or contested;

- Work with lawyers who are flexible, transparent, and fair.

Whether you just have questions or you’re ready to start, we’re here to make this easier.

Ready to Talk to a Probate Lawyer?

It’s okay to feel overwhelmed. But you don’t have to figure this out alone — and you don’t have to go broke to get the help you need. We’ll help you move forward one step at a time.Book your free consultation now and find out what your options are.

Thank you for your comment

It will be published after moderation

OwchBuddy

OwchBuddy

Comments 0