How long can you make a claim after an accident: know your legal deadlines

Accidents can be life-changing events, leading to physical injuries, emotional trauma, and financial burdens. One critical aspect that accident victims need to be aware of is the time frame within which they can file a claim. This period, known as the statute of limitations, varies depending on the type of claim and the state where the accident occurred. Understanding these timelines is crucial to ensure that you don’t miss your opportunity to seek compensation. In this article, we’ll explore how long can you make a claim after an accident and all the general rules regarding the statute of limitations for accident claims in the USA.

How long do you have to file an insurance claim in the USA?

To file an insurance claim promptly after an accident is essential to ensure you receive the compensation you’re entitled to. The time frame for filing a claim can vary depending on the type of insurance, the nature of the claim, and the specific terms outlined in your insurance policy. Understanding these time limits and the importance of acting quickly can help you navigate the claims process more effectively. Explore the general timelines for filing different types of insurance claims in the USA.

General guidelines for filing insurance claims:

1. Auto insurance claims

Auto insurance policies generally require policyholders to report accidents as soon as possible. Most insurers specify a timeframe within which you must notify them, often ranging from 24 hours to a few days after the accident. The actual deadline for filing a claim can vary:

- Collision and claims: These claims typically must be filed promptly, usually within 30 days of the accident, depending on the insurer’s policy.

- Personal injury protection (PIP) claims: In states with no-fault insurance laws, PIP claims often have a strict filing deadline, commonly within 14 to 30 days from the date of the accident.

2. Homeowners insurance claims

Homeowners insurance policies require prompt notification of any damage or loss. The time limit for filing a claim can vary:

- Property damage claims: Generally, you should report damage to your home as soon as it occurs or is discovered. Most policies expect you to file a claim within 30 days to a year, depending on the insurer.

- Liability claims: If someone is injured on your property, you should notify your insurer immediately, typically within a few days to a month, as specified in your policy.

3. Health insurance claims

Health insurance claims usually need to be filed within a specific period after receiving medical services:

- Standard health insurance claims: These claims often must be filed within 90 days to one year from the date of service, depending on the insurance provider.

- Out-of-network claims: If you received treatment from an out-of-network provider, the filing deadline might be shorter or require additional documentation.

4. Life insurance claims

Filing a life insurance claim involves notifying the insurer of the policyholder’s death and providing necessary documentation. There is generally no strict deadline, but it’s advisable to file as soon as possible to expedite the claims process. Most insurers prefer claims to be filed within one to two years from the date of death.

5. Disability insurance claims

Disability insurance policies typically require prompt filing once you become disabled:

- Short-term disability claims: These usually need to be filed within 30 days of the onset of the disability.

- Long-term disability claims: Filing deadlines can range from 90 days to one year, depending on the policy terms.

6. Travel insurance claims

Travel insurance policies often have specific timeframes for filing claims related to trip cancellations, medical emergencies, or lost luggage. Generally, you should file within 20 to 90 days from the incident.

How long after car accident can you file a claim in the USA: general time limits for different types of claims

The statute of limitations is a legal time limit within which you must file a lawsuit or a claim. If you fail to file within this period, you may lose your right to seek compensation for your injuries or damages. The purpose of these laws is to ensure that claims are made while evidence is still fresh and to provide a sense of legal certainty for all parties involved. To know how long after car accident can you file a claim, explore general time limits for different types of claims.

1. Personal injury claims

Personal injury claims, which include car accidents, slip and fall incidents, and other accidents resulting in bodily harm, typically have a statute of limitations ranging from one to six years. The exact time frame depends on the state:

- California: 2 years

- Florida: 4 years

- New York: 3 years

- Texas: 2 years

2. Property damage claims

Claims solely for property damage, such as damage to your vehicle or personal property, also have varying time limits. Generally, these limits are similar to or slightly longer than those for personal injury claims, often ranging from two to six years.

3. Medical malpractice claims

Medical malpractice claims have more complex statutes of limitations due to the nature of discovering injuries. Typically, these claims must be filed within two to four years from the date of the injury or from when the injury was discovered:

- California: 1 year from discovery, but no more than 3 years from the date of injury

- Florida: 2 years from discovery, but no more than 4 years from the date of injury

- New York: 2.5 years

- Texas: 2 years

4. Wrongful death claims

Wrongful death claims, brought by the family or estate of a deceased person who died due to another’s negligence, generally have a statute of limitations ranging from one to three years:

- California: 2 years

- Florida: 2 years

- New York: 2 years

- Texas: 2 years

How to make an insurance claim later legally: factors that can affect the statute of limitations

Several factors can influence the statute of limitations for you to make an insurance claim right:

1. Discovery rule

In some cases, the statute of limitations may be extended based on the “discovery rule.” This rule applies when the injury or damage was not immediately apparent. The clock starts ticking when the injury or damage is discovered or should have reasonably been discovered.

2. Minors and incapacitated persons

If the injured party is a minor or legally incapacitated, the statute of limitations may be tolled (paused) until the minor reaches the age of majority or the incapacitation is lifted.

When do you need to file auto insurance claim sooner?

To file auto insurance claim promptly is crucial for ensuring that you receive the compensation you’re entitled to. While general guidelines suggest that you should report accidents and file claims as soon as possible, certain situations necessitate even quicker action. Understanding when you need to file an auto insurance claim sooner can help you avoid complications and delays in receiving your benefits.

1. Government entities

Claims against government entities often have shorter time frames and may require additional procedural steps, such as filing a notice of claim within a specified period (often six months to one year).

2. Contractual limitations

Certain contracts, such as insurance policies, may contain their own deadlines for filing claims, which can be shorter than the state’s statute of limitations.

While understanding the statute of limitations is crucial, it’s equally important to act promptly after an accident. Evidence can degrade, witnesses’ memories can fade, and opposing parties can prepare their defenses. The sooner you consult with an attorney and begin the claims process, the better your chances of securing the compensation you deserve.

How can OwchBuddy help you in your case?

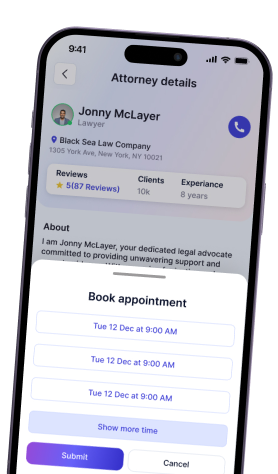

OwchBuddy’s AI assistant will analyze your situation and help determine an individual action strategy. If the AI finds that you urgently need a qualified professional, it will assist in finding one quickly.

OwchBuddy app operates by analyzing your situation and matching you with the most suitable specialist from its database. OwchBuddy’s database brings together top specialists from all states. It includes lawyers specializing in various cases with relevant experience, which plays a crucial role in every matter. You can schedule a consultation and conduct a video meeting directly in the app without wasting time.Download the OwchBuddy app at Google Play or the App Store to have a reliable decision-making assistant at your fingertips in moments of doubt. It not only answers questions and finds specialists but also keeps all documentation in one place. It’s not just an app; it’s a companion throughout your journey.

Thank you for your comment

It will be published after moderation

OwchBuddy

OwchBuddy

Comments 0