Are Personal Injury Settlements Taxable?

If you’ve recently won a personal injury settlement, first of all — congrats. That check in your hands might feel like the end of a long road. But before you celebrate too soon, there’s one important question to ask: is any part of your settlement taxable?

Understanding the tax rules can help you keep more of what you rightfully deserve. The following guide explains current IRS doctrine, common pitfalls, and proven risk‑mitigation tactics so you can safeguard the funds you fought to obtain.

Are Personal Injury Settlements Taxable Under Federal Law?

In most personal injury cases, the IRS does not consider your compensation for physical injuries or sickness to be taxable. That’s the good news.

The non-taxable portion of a settlement typically includes:

- Compensation for physical injuries or illness;

- Medical expenses (even past ones);

- Emotional distress directly related to the physical injury;

- Legal fees tied to non-taxable compensation.

Because the IRS views this money as restoring you to your pre‑injury status rather than enriching you, it is exempt from Form 1040 reporting. Still, the rule contains critical exceptions that can convert portions of an otherwise tax‑free award into taxable income.

What Parts of a Settlement Could Be Taxed?

Even when the underlying claim involves physical harm, certain categories fall outside §104(a)(2) and are subject to ordinary‑income tax. In some cases, even to payroll or self‑employment tax.

- Punitive damages (meant to punish the wrongdoer, not compensate you);

- Interest that accumulated while the settlement was pending;

- Compensation for emotional distress if not tied to a physical injury;

- Lost wages (if treated like income replacement).

If your award includes any of these elements, that slice of the check must be reported on Line 8k (Other Income) of Form 1040 for the year in which the funds are received.

Pro tip: how your agreement is worded matters. If the structure clearly separates taxable from non-taxable components, you’ll have an easier time with the IRS.

Why the Settlement Agreement’s Wording Is Everything

Taxability hinges not just on what happened in court, but on how the parties memorialize the outcome in writing. A well‑drafted agreement will allocate specific dollar amounts—e.g., “$250,000 for physical injury” (non‑taxable) and “$50,000 punitive damages” (taxable).

Although the IRS is not bound by mere labels, it generally respects reasonable allocations that align with the facts and court pleadings. Failure to spell out the breakdown invites the Service to apportion the lump sum using its own formula, which rarely benefits the taxpayer.

Example: suppose a jury awards $600,000, and the agreement does not specify categories. If the verdict form shows $100,000 was for lost wages and $50,000 was pre‑judgment interest, the IRS will treat $150,000 as taxable even if you had assumed the entire amount was injury‑related.

What About State Taxes?

Most states depend on federal rules, but there are notable deviations:

- Pennsylvania taxes punitive damages but excludes lost wages in physical‑injury cases;

- New York mirrors the IRC, but may assess state income tax on prejudgment interest if it accrued for more than two years;

- Illinois conforms to federal exclusions yet requires add‑back of attorney’s fees when calculating state adjusted gross income.

Because state policy can diverge on items such as emotional‑distress damages, always cross‑check the Department of Revenue’s latest bulletin or let counsel licensed in that jurisdiction do it for you. You can find the perfect legal advice for your case using OwchBuddy’s services.

3 Ways to Minimize Tax Risk from Your Settlement

The following strategies apply before, during, and immediately after settlement negotiations and can significantly reduce exposure:

- Structure your agreement carefully. The language in your settlement agreement matters. If you’re working with a lawyer, make sure they spell out what each part of your compensation is for—especially if it includes both taxable and non-taxable items.

- Maintain solid documentation. Medical records, receipts, and communication with healthcare providers help prove that compensation is for physical injury—keeping it tax-free.

- Partner with an experienced attorney. They’ll help you negotiate a clean agreement that protects your finances—now and in the long run.

Implementing even one of these tactics can shield tens of thousands of dollars that might otherwise flow to the Treasury.

Already Cashed the Check? Here’s What to Do

If your case is already closed and the agreement isn’t specific about the breakdown, you might still have options.

Here’s what you can do:

- Ask your attorney for a breakdown of your settlement.

- Review the original documentation for mentions of taxable damages or interest.

- Work with a tax advisor to properly report the income.

Important: Do not simply omit the income and hope for the best; doing so can trigger accuracy‑related penalties of 20 percent, and even up to 40 percent for gross valuation misstatements, on top of back taxes and interest.

How OwchBuddy Makes It Easier to Protect Your Money

Plaintiffs often assume their personal‑injury attorney will handle tax questions, yet many litigators rightly view tax planning as outside their remit. Partnering with a multidisciplinary team closes this gap.

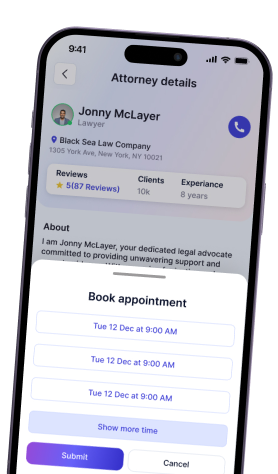

At OwchBuddy, we help clients maximize what they keep from settlements and avoid surprise taxes.

Here’s how we can help:

- Connect you with a personal injury attorney who understands tax law;

- Review your case and settlement terms for tax-related risks;

- Help you make smarter choices before you sign any paperwork;

We’ve helped thousands of clients through this process. Let us do the same for you.

Need Legal Help You Can Trust?

We get it – settlements are confusing. And the last thing you want is to lose a big chunk of it to taxes you could’ve avoided. That’s why we’re here.

Talk to a personal injury lawyer today who understands both injury law and taxes. You’ll get:

- A clear explanation of what’s taxable and what’s not;

- Help structuring your agreement the right way;

- Peace of mind as you move forward.

Book your free consultation now to start taking control over the process. You’ll get full control over your recovery with clarity, confidence, and a little help from OwchBuddy.

Thank you for your comment

It will be published after moderation

OwchBuddy

OwchBuddy

Comments 0