How Much Does a Lawyer Charge to Transfer a Deed?

Maybe you’re passing a home to your child. Perhaps it’s part of a divorce, or you just lost a loved one and need to get the title into your name. Whatever the reason, transferring a deed sounds simple — until you actually try to do it.

That’s when the questions start:

- Do I need a lawyer for this?

- What’s a deed transfer even involve?

- How much is it going to cost me?

Transferring a deed is often easy – but not always. One wrong form, a missed signature, or the wrong wording, and you could end up with a legal mess that takes months (or more) to fix. If you’re here, you’re likely trying to avoid that. And you’re smart for asking before jumping in.

What Does It Mean to Transfer a Deed?

A deed is the legal document that proves who owns real property. A deed transfer changes the name on that document and must be recorded with the county recorder or clerk to be valid. Common scenarios include multiple options.

| Typical Reason | Example |

| Family gift | Parent deeds a rental house to an adult child. |

| Divorce settlement | One spouse keeps the marital home. |

| Estate distribution | Heirs receive title after probate. |

| Asset planning | Owner moves property into a living trust or LLC. |

Whatever the situation, that transfer needs to be filed and recorded correctly at the county level — otherwise, it may not be legally recognized. That’s why you need a lawyer.

Why Hire a Lawyer?

Yes, you can find deed templates online. But just because you can do it yourself doesn’t mean you should — especially when real estate law is involved. Even a minor error like using the wrong deed type or missing a small legal detail can cause:

- Ownership confusion;

- Delays in refinancing or selling;

- Title problems for future buyers;

- Extra legal costs down the line.

A lawyer makes sure the transfer is done properly, using the correct document for your situation. They’ll also confirm ownership, check for liens, and ensure the property can actually be transferred. Apart from that, there are also many other risks if you decide to work for yourself.

| DIY Risk | Potential Fallout |

| Use wrong deed type (quitclaim vs. warranty) | Buyer/successor can sue over undisclosed defects. |

| Omit critical language (marital rights, survivorship) | Property may pass to unintended heirs. |

| Ignore existing liens or mortgages | Transfer violates lender’s “due-on-sale” clause or clouds title. |

| Miss a tax trigger | Gift-tax penalties or capital-gains surprises during resale. |

If there’s a trust, LLC, mortgage, or out-of-state heir involved, it gets even more complicated — and that’s where professional help really matters.

What Does a Lawyer Actually Do in a Deed Transfer?

Hiring an attorney is more than paying for a stamped signature. A licensed real-estate or estate-planning lawyer regulates the deed from first phone call to final county recording, eliminating pitfalls that can derail financing, trigger tax penalties, or cloud title for years.

A real estate attorney will usually support you step-by-step.

| Stage | Attorney’s Actions | Why It Matters |

| 1. Initial Intake & Goal Setting | Ask who is giving and receiving the property, marital status of each party, and reason for transfer (gift, sale, divorce, estate, trust, LLC, etc.).Determine deadlines—refinance closing, probate timeline, IRS gift-tax filing window. | Ensures the right deed type, tax strategy, and recording procedure from day one. |

| 2. Title & Lien Due Diligence | Order or perform a title search to confirm current ownership, legal description, easements, and existing liens/mortgages.Flag HOA covenants, tax delinquencies, and judgments that must be cleared or disclosed. | Prevents transferring a “dirty” title that lenders or future buyers will reject—and protects both giver and recipient from hidden debt. |

| 3. Choose the Proper Deed Form | Select among Warranty, Special Warranty, Quitclaim, Bargain-and-Sale, Lady Bird, or Transfer-on-Death (TOD) deeds, depending on state law and liability goals.Draft ancillary documents (Affidavit of Survivorship, Homestead Waiver, Spousal Consent, Entity Resolutions). | The wrong deed can leave the grantor liable for future defects or expose the grantee to unexpected claims. |

| 4. Draft Precise Legal Language | Insert statutory wording—consideration clause, granting language, legal description verbatim from prior deed, parcel ID, and return address.Incorporate state-specific requirements (font size, margin size, witness clauses). | County recorders reject deeds for tiny formatting errors; lawyers build in compliance so the document is accepted on first submission. |

| 5. Tax & Financial Counseling | Explain gift-tax thresholds, capital-gains basis, property-tax reassessment, and Medicaid look-back rules.Prepare transfer-tax forms (TP-584, PCOR, DR-228, etc.) or exemptions for intra-family transfers. | A quick “free” deed can morph into tens of thousands in tax liability if handled incorrectly. |

| 6. Coordinate Execution | Schedule signings, arrange mobile notary or in-office witnesses per state law (some states need two witnesses).Verify photo IDs, marital status affidavits, and entity authority (if a trust, LLC, or executor is signing). | Improper witnessing or missing notarial blocks invalidate deeds—forcing re-signing and possible litigation. |

| 7. Lender & Third-Party Consents | Obtain mortgagee approval for transfers that trigger “due-on-sale” clauses or prepare subject-to-mortgage language.Collect HOA, co-op board, or municipal certifications if required. | Without lender consent, the bank can accelerate the loan or refuse refinancing later. |

| 8. Record the Deed | Deliver or e-file deed with county clerk/recorder, pay recording and transfer taxes.Track status until stamped copy is returned; errors corrected immediately. | Only recordation gives public notice and protects grantee ownership against later claims. |

| 9. Post-Recording Follow-Up | Provide certified copy to client, title company, and lender.Update estate plan (wills, trusts) and advise client on new insurance needs.File gift-tax return (Form 709) or entity minutes, if applicable. | Ensures every downstream document matches the new ownership structure—avoiding conflicts at sale, refinance, or probate. |

| 10. Liability & Malpractice Coverage | Maintain professional-liability insurance; assume responsibility for drafting accuracy and filing deadlines. | Gives the client financial recourse if an error slips through—DIY websites do not carry this safety net. |

It may seem simple from the outside, but getting it right means covering all the fine print — and making sure there are no unpleasant surprises later.

How Much Does a Lawyer Charge?

Now to the main question. Most lawyers will charge a flat fee for a straightforward deed transfer.

In general, expect:

- Flat fee range: $200 to $600;

- Hourly rate (for complex cases): $200 to $450/hour

- Total cost for more involved matters: $750 to $2,500+

If you’re just transferring ownership between family members or cleaning up a title, it’s usually on the lower end. But if the transfer is tied to a divorce, estate, or legal dispute, expect higher fees — especially if extra paperwork or negotiations are involved.

What Other Costs Might Be Involved?

Besides the attorney’s fee, you’ll likely run into many other fees. Examples are listed below.

| Cost Item | Typical Range (2025) | What Triggers or Changes the Fee |

| County Recording Fee | $25 – $100 | Set by local ordinance; higher in metro counties and for multipage deeds. |

| Transfer / Documentary Stamp Tax | 0% – 2% of assessed or sale value | Calculated on consideration or taxable value (e.g., FL $0.70 per $100; NYC up to 2.625 %). |

| Title Search or Owner’s Title Report | $75 – $200 | Verifies chain of title, liens, easements, and legal description. |

| Notary Fee | $10 – $40 (in-office)$75 – $150 (mobile) | Every grantor’s signature must be notarized; some states also need two witnesses. |

| Lien-Release Recording | $30 – $75 per lien | Paid when recording satisfactions for mortgages, HELOCs, or tax liens. |

| HOA / Condo Transfer or Estoppel | $100 – $450 | Confirms dues status; required in many planned communities. |

| Courier / Overnight Delivery | $25 – $60 | Physical deeds sometimes need “wet” signatures sent to the county or lender. |

| Property Tax or Assessment Proration | Varies by closing date | If transfer is tied to a private sale or estate settlement mid-tax year. |

Ask your lawyer for a full breakdown up front so you know what to expect.

Can You Transfer a Deed Without a Lawyer?

Technically, yes. But if the transfer goes wrong (if it’s rejected by the county, if it creates tax issues, or if the title isn’t clear), fixing it later is a lot more expensive than doing it right the first time.

DIY deed transfers make the most sense if:

- It’s a very simple family transfer;

- You understand your state’s real estate laws;

- There’s no mortgage or lien;

- No one is going to dispute the change.

Even then, it’s worth running the documents by a lawyer for review — which may only cost a few hundred dollars and give you peace of mind. That’s why you might want to get help from professional attorneys.

When You Definitely Need Legal Help

Here are situations where hiring a lawyer isn’t optional – it’s the smart move:

- You’re transferring property as part of a divorce or legal settlement;

- The property is in a trust or part of an estate;

- You’re dealing with out-of-state ownership;

- There’s a mortgage still on the property;

- You’re unsure which type of deed to use (warranty, quitclaim, etc.);

- You want to avoid future tax complications or title issues.

If the stakes are high or the property is worth a lot, a few hundred bucks for professional help is usually a small price to pay.

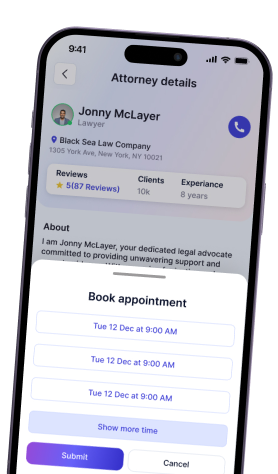

How OwchBuddy Can Help

We understand that legal paperwork can be intimidating, especially when it comes to something as important as real estate ownership. That’s why we’ve made it easy to connect with lawyers who handle deed transfers every day — and explain everything simply.

Through OwchBuddy, you can:

- Talk to a lawyer who understands your local laws;

- Get a flat-rate price — no surprise billing;

- Get clear answers on taxes, inheritance, and liability;

- Let a pro handle the paperwork, filing, and communication;

- Feel confident everything was done the right way.

We’ve helped hundreds of families make smooth property transfers without the stress, guesswork, or last-minute problems. Transferring a deed might seem like just paperwork — but it’s actually a key legal moment. It affects ownership, taxes, and even your ability to sell or refinance later.

Getting it done right now can save you (or your family) a serious headache later. And in most cases, it doesn’t cost as much as you might think. If you’re unsure where to start or whom to call, let us help.

Get the Help You Need With OwchBuddy

At OwchBuddy, we make it easy to connect with lawyers who get the job done — quickly, clearly, and without confusion. Because legal ownership should be simple and secure.

Talk to a deed transfer lawyer today and get your property paperwork handled with care.

Thank you for your comment

It will be published after moderation

OwchBuddy

OwchBuddy

Comments 0