Hurricane Insurance Lawyer Guide: How to Get Help with Claims and Maximize Payouts

When disaster strikes in the form of a hurricane, it leaves devastation in its wake, affecting homes, vehicles, and personal property. Filing insurance claims to recover these losses can be a complex and frustrating process, especially when insurers undervalue or deny your claim. In such cases, a hurricane insurance lawyer becomes an essential ally. These specialized attorneys can help you navigate the legal intricacies of storm-related claims, ensuring you maximize your compensation.

This guide, powered by OwchBuddy, will cover how to find the right legal help for hurricane damage, from working with a hurricane insurance lawyer to specialized attorneys for various types of storm-related claims.

Hurricane insurance lawyer: why you need one

After a hurricane or other natural disaster, filing a claim with your insurance company can be challenging. Insurance policies are often dense with technical language, and it’s easy for homeowners to miss critical details. This is where a hurricane insurance lawyer steps in to help.

1. Understand policy terms

A hurricane insurance lawyer can interpret your insurance policy and explain what coverage you are entitled to. Homeowners may have questions about what damages are covered—whether it’s structural damage to their house, personal belongings, or loss of use during repairs. A lawyer can clarify what your insurer is responsible for paying and if there are any policy exclusions.

2. Handle denied or underpaid claim

Many people are frustrated when their insurance claims are denied or when the payout is far less than expected. Insurance companies sometimes use complex tactics to reduce their liability. A hurricane insurance lawyer will challenge the denial, negotiate with the insurance company, and make sure you receive the compensation you deserve.

3. Speed up the process

Hurricanes create a flood of claims, overwhelming insurance companies and delaying payouts. A lawyer who specializes in hurricane claims can help expedite the process by pushing insurers to take immediate action on your claim.

Storm damage attorney: dealing with destruction

Hurricanes cause more than just water damage—they can also wreak havoc with winds, downed trees, and flying debris. A storm damage attorney can handle cases involving various types of destruction caused by extreme weather conditions, including:

1. Wind damage

High winds during hurricanes can rip off roofs, break windows, and knock down trees that damage property. Filing a wind damage claim requires documentation of the damage and proof that it was caused by the storm. A storm damage attorney can help you gather the necessary evidence and ensure that your insurance covers all related repairs.

2. Debris damage

Flying debris during a storm can cause significant damage to homes and vehicles. If your property is hit by objects carried by the wind, your insurance should cover the damage. However, disputes may arise over whether the debris was part of the storm event. A storm damage attorney can argue on your behalf to ensure proper compensation.

3. Tree damage

If a tree on your property falls and damages your house, the insurance company may try to claim that the tree was already weakened or diseased before the storm. An attorney will counter this by proving that the hurricane was the direct cause of the tree falling.

Natural disaster attorney: legal help beyond hurricanes

While hurricanes are a major natural disaster that impacts millions of Americans, other weather events such as tornadoes, floods, and wildfires can also cause significant damage. A natural disaster attorney specializes in helping victims of these disasters recover compensation from their insurance companies.

1. Tornadoes

Tornadoes can flatten homes and destroy communities within minutes. Like hurricanes, filing a claim after a tornado can be complicated. A natural disaster attorney will ensure that all damages, including structural loss and personal property damage, are accounted for.

2. Wildfires

In areas prone to wildfires, residents often face battles with their insurers over fire damage claims. Insurance companies may argue that homes were already at risk due to inadequate fireproofing. A natural disaster attorney can challenge these claims, ensuring that homeowners receive full compensation for their losses.

3. Floods

Flood damage is often a separate type of insurance coverage and can be complex to navigate. A natural disaster attorney can help you handle disputes over coverage, particularly if the insurance company argues that the flooding was caused by something other than the storm.

Flood damage lawyer: Navigating complex water damage claims

Flooding caused by hurricanes is one of the most common and devastating consequences of these storms. However, not all flood damage is covered under standard homeowners’ insurance policies. Most homeowners need separate flood insurance to protect their properties from water damage. Here’s where a flood damage lawyer comes into play:

1. Flood insurance disputes

If your home was flooded during a hurricane and you file a claim under your flood insurance policy, the insurer might contest the extent of the damage or argue that part of the damage was pre-existing. A flood damage lawyer can review your flood policy, help document your losses, and fight for a fair settlement.

2. Water vs. wind damage

After hurricanes, insurance companies may try to differentiate between water damage (covered by flood insurance) and wind-driven rain damage (which may be covered by homeowners’ insurance). A flood damage lawyer can help you prove that the damage was due to the hurricane, ensuring you get the compensation you deserve from all relevant policies.

3. Handling large claims

When the damage is extensive, insurance companies often dispute large claims or delay payouts. A flood damage lawyer can represent your interests in negotiations or, if necessary, file a lawsuit to ensure you are fully compensated for your losses.

Property damage lawyer: Complete representation

Hurricanes cause more than just water or wind damage—they can lead to a wide range of property issues, from destroyed homes to damaged vehicles. A property damage lawyer provides comprehensive representation for all types of damage claims, ensuring that every aspect of your property loss is addressed.

1. Personal property claims

In addition to structural damage, personal belongings such as furniture, electronics, and clothing may also be destroyed during a hurricane. A property damage lawyer will ensure that your claim includes the full value of your lost or damaged personal property.

2. Automobile damage

Cars and trucks are often damaged by floods, flying debris, or falling trees during hurricanes. While your auto insurance may cover some of the damage, a property damage lawyer can help you determine if your policy adequately compensates you for your vehicle’s loss and negotiate with the insurer for a fair payout.

3. Loss of use

If your home is uninhabitable due to storm damage, your insurance may cover additional living expenses such as hotel stays, meals, and other costs incurred while your home is being repaired. A property damage lawyer will ensure that these costs are fully compensated and not overlooked by your insurer.

Steps you need to take after a hurricane to get compensation

After a hurricane strikes, the road to recovery can be long and challenging, especially when it comes to filing insurance claims for the damage caused. Knowing the proper steps to take immediately after the storm will significantly improve your chances of receiving full compensation from your insurance company.

1. Ensure safety first

Before thinking about claims and compensation, make sure you and your loved ones are safe. Evacuate if necessary, avoid downed power lines, and follow local authorities’ safety guidelines. Safety is the priority, so don’t return to your property until it’s safe to do so.

2. Document the damage

Once it’s safe to return to your property, begin documenting all the damage caused by the hurricane. This step is crucial for substantiating your insurance claim later on. Here’s how you can document the damage effectively:

- Take photos and videos: Capture clear images and videos of every part of your home, personal belongings, and property that has been affected. Be thorough and cover all areas, from structural damage to water-damaged furniture.

- Create an inventory: Make a list of damaged or lost items, including furniture, electronics, appliances, and personal belongings. Be sure to include the estimated value of each item.

- Save receipts and bills: Keep any receipts related to temporary repairs, alternative living expenses, or damaged personal belongings, as these will help in justifying your claim.

3. Prevent further damage

Most insurance policies require you to take reasonable steps to prevent further damage to your property. After documenting the damage, make temporary repairs to avoid any worsening of the situation. For example, cover broken windows, tarp over roof damage, or remove water from flooded areas. However, don’t make permanent repairs until your insurance company has assessed the damage.

4. Review your insurance policy

Understanding your policy is key to knowing what compensation you are entitled to. Read through your homeowners’ or flood insurance policy and take note of the following:

- Coverage details: What types of damages are covered under your policy? Some policies might only cover wind damage and exclude flooding, while others provide broader coverage.

- Exclusions: Check for any exclusions in your policy, such as specific limits on certain types of damage or requirements for maintenance.

- Deductibles: Know how much your deductible is and whether it applies separately for wind and flood damage. Some hurricane policies have higher deductibles, especially for storm-related claims.

5. File your insurance claim promptly

Once you have a full understanding of your coverage and have documented the damage, it’s time to file your insurance claim. Filing promptly is crucial, as delays can result in processing setbacks. Here are the steps to file a claim:

- Contact your insurer: Reach out to your insurance company to notify them of the hurricane damage and your intent to file a claim.

- Provide the necessary documentation: Submit the photos, videos, inventory list, and any receipts you have collected as evidence of your losses.

- Keep records of communication: Document every communication you have with the insurance company, including phone calls, emails, and letters. This helps in case of disputes or delays in processing your claim.

6. Get an independent damage assessment

While your insurance company will send its own adjuster to assess the damage, it’s also a good idea to hire an independent contractor or public adjuster to provide an objective estimate of the damage. Having a second opinion can help ensure you are not undercompensated by the insurer’s assessment.

7. Consult a hurricane insurance lawyer

If your claim is denied, underpaid, or delayed, it may be time to consult a hurricane insurance lawyer. Even if you’re not facing immediate issues, having a lawyer review your case can help identify potential pitfalls and ensure you’re getting the maximum payout.

A hurricane insurance lawyer can:

- Negotiate with the Insurance company: Lawyers have the legal expertise to challenge unfair claims and negotiate for a better settlement.

- Help with disputed claims: If your insurer disputes the cause or extent of the damage, a lawyer can present a stronger case with supporting evidence.

- Expedite the claims process: By involving a lawyer early on, you can prevent unnecessary delays and receive your compensation faster.

8. Stay organized and follow up

The claims process can take time, especially after a widespread disaster like a hurricane. Keep all your documents organized, including communications with your insurer, estimates, receipts, and reports. If you don’t hear back within the expected timeframe, follow up with the insurance company to check the status of your claim.

Hurricane damage statistics in the USA

Hurricanes have caused significant damage across the United States in recent years, with major storms affecting millions of homes and businesses. Here are some key statistics on hurricane damage in the U.S. over the last five years:

1. Hurricane Ida (2021)

Hurricane Ida caused over $75 billion in damage across the southeastern U.S. and parts of the Northeast. The storm caused widespread flooding, power outages, and destruction of infrastructure.

2. Hurricane Laura (2020)

Hurricane Laura hit Louisiana with wind speeds of 150 mph, causing approximately $19 billion in damages. Entire towns were destroyed, and thousands of residents were displaced.

3. Hurricane Dorian (2019)

While Hurricane Dorian primarily impacted the Bahamas, it also caused $1.6 billion in damage in the U.S., particularly along the southeastern coast.

4. Hurricane Michael (2018)

Hurricane Michael was one of the most powerful storms to hit Florida, causing over $25 billion in damage. Wind and storm surges caused widespread devastation to homes and businesses.

5. Hurricane Harvey (2017)

Hurricane Harvey brought catastrophic flooding to Texas, with total damages estimated at $125 billion. It caused one of the largest hurricane-related insurance payouts in U.S. history.

These numbers highlight the immense financial toll hurricanes can take on individuals and communities, further emphasizing the importance of having legal assistance to navigate insurance claims.

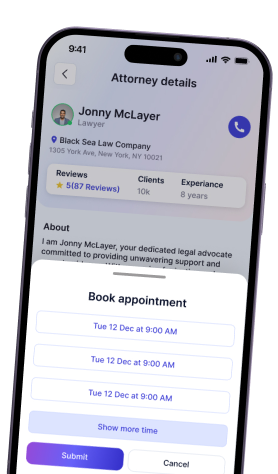

Download OwchBuddy: Simplify your hurricane insurance claims

Dealing with the aftermath of a hurricane can be stressful and overwhelming, but you don’t have to go through it alone. OwchBuddy offers an easy way to get help with your insurance claims by connecting you with experienced hurricane insurance lawyers. Whether you’re facing a denied claim or need help understanding your coverage, OwchBuddy’s AI assistant and network of specialized attorneys are here to guide you.

Download OwchBuddy on Google Play or the App Store today and get the legal assistance you need to maximize your hurricane insurance payout. Don’t leave your compensation to chance—let OwchBuddy help you recover what you deserve!

Thank you for your comment

It will be published after moderation

OwchBuddy

OwchBuddy

Comments 0