What is Personal Injury Protection (PIP) and how does it cover accident costs?

Personal Injury Protection (PIP) is an essential component of auto insurance policies in several states across the USA. Often referred to as “no-fault insurance,” PIP provides coverage for medical expenses and, in some cases, lost wages and other damages, regardless of who is at fault in an accident. Understanding what is personal injury protection and its benefits can help you navigate the complexities of auto insurance and ensure you are adequately protected.

What is Personal Injury Protection insurance?

Personal Injury Protection (PIP) is a type of auto insurance coverage designed to pay for medical expenses and other accident-related costs, irrespective of who caused the accident. It is mandatory in some states and optional in others, providing an extra layer of financial protection for drivers and passengers.

Key features of PIP:

- No-fault overage: PIP covers your medical expenses regardless of who was at fault in the accident.

- Medical expenses: It covers medical costs, including hospital visits, surgeries, and rehabilitation.

- Lost wages: PIP can compensate for lost income if your injuries prevent you from working.

- Funeral costs: In the event of a fatal accident, PIP can cover funeral expenses.

- Essential services: What is PIP also paying for essential services you cannot perform due to your injuries, such as childcare or house cleaning.

Benefits of PIP Coverage

1. Quick access to medical care

Since PIP is no-fault insurance, you can access medical care promptly without waiting for fault determination. This is crucial for receiving timely treatment and beginning your recovery process.

2. Financial security

Personal Injury Protection insurance offers financial protection by covering medical expenses and lost wages, which can alleviate the economic burden of an accident, especially if you face significant medical bills or cannot work for an extended period.

3. Global coverage

PIP coverage is valid for a wide range of expenses, from medical bills to essential services and funeral costs, providing financial support in the aftermath of an accident.

PIP insurance meaning: нow does PIP cover accident costs?

1. Medical expenses

PIP is primarily designed to cover medical expenses resulting from an auto accident. This includes:

- Emergency room visits: Immediate care required post-accident.

- Hospital stays: Costs associated with hospitalization.

- Surgical procedures: Expenses for surgeries needed due to injuries.

- Rehabilitation and therapy: Physical therapy and other rehabilitative services.

- Medical supplies: Costs for necessary medical supplies like crutches or braces.

2. Lost wages

If your injuries from an auto accident prevent you from working, PIP can help compensate for your lost income. The coverage amount and duration depend on your policy specifics and state regulations.

3. Funeral expenses

In the unfortunate event of a fatal accident, PIP can cover funeral and burial costs, providing financial relief to the bereaved family.

4. Essential services

If your injuries render you unable to perform daily tasks or essential services, PIP can cover the costs of hiring help. This might include:

- Childcare services: Payment for childcare if you are unable to take care of your children due to injuries.

- Housekeeping: Costs of hiring someone to help with household chores.

- Other essential tasks: Coverage for other necessary services you cannot perform because of your injuries.

5. Survivor benefits

In some states, PIP provides survivor benefits to family members if the policyholder dies as a result of an auto accident. PIP insurance meaning can include continued payments of medical benefits or compensation for lost income.

What does PIP insurance stand for different states?

You should understand what does PIP insurance stand for in many states, particularly in those with no-fault insurance laws. The specifics of PIP coverage, including what it covers and how it is implemented, can vary significantly from state to state. Here’s an overview of what PIP insurance entails in different states:

States with mandatory PIP coverage

1. Florida

- PIP coverage requirements: Minimum of $10,000 in medical and disability benefits and $5,000 in death benefits.

- Details: Covers medical expenses, lost wages, and death benefits, regardless of fault.

2. New York

- PIP coverage requirements: Minimum of $50,000 per person.

- Details: Covers medical expenses, lost wages, and other expenses such as transportation to medical appointments.

3. Michigan

- PIP coverage requirements: Unlimited lifetime medical benefits for accident-related injuries (revised by recent legislation).

- Details: Coverage for medical expenses, lost wages, and attendant care. Recent reforms allow for different levels of PIP coverage.

4. Hawaii

- PIP coverage requirements: Minimum of $10,000 per person.

- Details: Covers medical expenses, rehabilitation, and lost wages.

5. Massachusetts

- PIP coverage requirements: Minimum of $8,000 per person.

- Details: Covers medical expenses, 75% of lost wages, and replacement services such as childcare and housekeeping.

6. New Jersey

- PIP coverage requirements: Minimum of $15,000 per person, with options for higher limits.

- Details: Covers medical expenses, lost wages, and essential services. Additional options are available for extended coverage.

7. Minnesota

- PIP coverage requirements: Minimum of $40,000 per person ($20,000 for medical expenses and $20,000 for non-medical expenses like lost wages).

- Details: Coverage for medical expenses, lost wages, and replacement services.

8. Utah

- PIP Coverage Requirements: Minimum of $3,000 per person.

- Details: Covers medical expenses, lost wages, and essential services.

States with optional PIP coverage

1. Oregon

- Optional PIP coverage requirements: Minimum of $15,000 per person.

- Details: Covers medical expenses, lost wages, and essential services.

2. Delaware

- Optional PIP coverage requirements: Minimum of $15,000 per person, up to $30,000 per accident.

- Details: Covers medical expenses, lost wages, and essential services.

3. Maryland

- Optional PIP coverage requirements: Minimum of $2,500 per person.

- Details: Covers medical expenses and lost wages. Policyholders can choose higher limits.

4. Kentucky

- Optional PIP coverage requirements: Minimum of $10,000 per person.

- Details: Covers medical expenses, lost wages, and essential services.

5. Texas

- Optional PIP coverage requirements: Minimum of $2,500 per person.

- Details: Covers medical expenses and lost wages. Higher limits can be purchased.

6. Pennsylvania

- Optional PIP coverage requirements: Minimum of $5,000 per person.

- Details: Covers medical expenses. Policyholders can choose higher limits and additional coverage options.

7. Washington

- Optional PIP coverage requirements: Minimum of $10,000 per person.

- Details: Covers medical expenses, lost wages, and essential services.

8. Kansas

- Optional PIP coverage requirements: Minimum of $4,500 per person for medical expenses, $900 per month for lost wages, and $25 per day for essential services.

- Details: Coverage for medical expenses, lost wages, and essential services.

Car insurance that pays for your injuries: steps to get your compensation

Getting compensated for injuries sustained in a car accident through your insurance involves several important steps. Here’s a detailed guide to help you to use car insurance that pays for your injuries through the process.

- Understand your coverage

- Immediately after the accident

Seek medical attention:

- Immediate care: Get medical help right away, even if injuries seem minor.

- Documentation: Keep detailed records of all medical treatments, diagnoses, and expenses.

Gather evidence:

- Accident scene: Take photos of the scene, injuries, and vehicle damage.

- Witness information: Collect contact details of witnesses.

- Police report: Obtain a copy of the police report.

3. Notify your insurance company

Report the accident:

- Timely notification: Inform your insurance company as soon as possible after the accident.

- Accident details: Provide all necessary details about the accident, including date, time, location, and involved parties.

4. File a claim

Prepare documentation:

- Medical records: Submit all medical records and bills related to injuries.

- Proof of lost wages: Provide documentation from your employer regarding missed work and lost income.

- Repair estimates: If applicable, include repair estimates for vehicle damage.

Complete claim form:

- Accurate information: Fill out the claim form accurately and thoroughly.

- Supporting documents: Attach all necessary documentation.

5. Work with the insurance adjuster

Initial contact:

- Assignment: An insurance adjuster will be assigned to your case.

- Evaluation: The adjuster will evaluate your claim based on the provided documentation.

Negotiation:

- Settlement offer: The adjuster will present a settlement offer.

- Negotiation: Negotiate if the offer does not fully cover your expenses.

6. Receive your compensation

Settlement agreement:

- Agreement: Once a settlement amount is agreed upon, sign the settlement agreement.

- Payment: The insurance company will process your payment.

Ongoing medical expenses:

- Future costs: Ensure future medical expenses are considered in the settlement if anticipated.

7. Dispute resolution

If your claim is denied:

- Review reasons: Understand the reasons for the denial.

- Additional evidence: Submit any additional documentation that supports your claim.

- Appeal: Follow the insurance company’s appeal process if necessary.

Legal assistance:

- Consult an attorney: If negotiations fail or your claim is unjustly denied, consider consulting a personal injury attorney.

- Lawsuit: As a last resort, you can file a lawsuit to seek compensation.

Tips for a smooth claims process

Stay organized:

- Keep records: Maintain a file with all documents related to the accident and your claim.

- Follow up: Regularly follow up with your insurance company and adjuster.

Communicate clearly:

- Be honest: Provide truthful and complete information.

- Document conversations: Keep a record of all communications with the insurance company.

Know your policy:

- Review coverage: Understand the limits and exclusions of your policy.

- Ask questions: Don’t hesitate to ask your insurance agent or adjuster for clarification.

What if you need a lawyer to fight for the amount of your compensation?

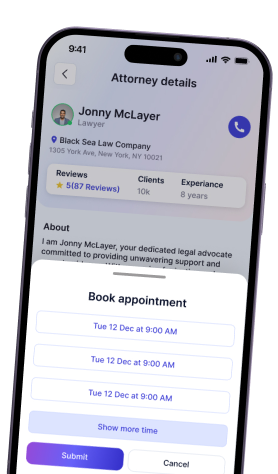

Seeking legal counsel can help you understand your rights and potential compensation based on the specifics of your case. OwchBuddy’s AI assistant will analyze your situation and help determine an individual action strategy. If the AI finds that you urgently need a qualified professional, it will assist in finding one quickly.

OwchBuddy app operates by analyzing your situation and matching you with the most suitable specialist from its database. OwchBuddy’s database brings together top specialists from all states. It includes lawyers specializing in various cases with relevant experience, which plays a crucial role in every matter. You can schedule a consultation and conduct a video meeting directly in the app without wasting time.Download the OwchBuddy app at Google Play or the App Store to have a reliable decision-making assistant at your fingertips in moments of doubt. It not only answers questions and finds specialists but also keeps all documentation in one place. It’s not just an app; it’s a companion throughout your journey.

Thank you for your comment

It will be published after moderation

OwchBuddy

OwchBuddy

Comments 0